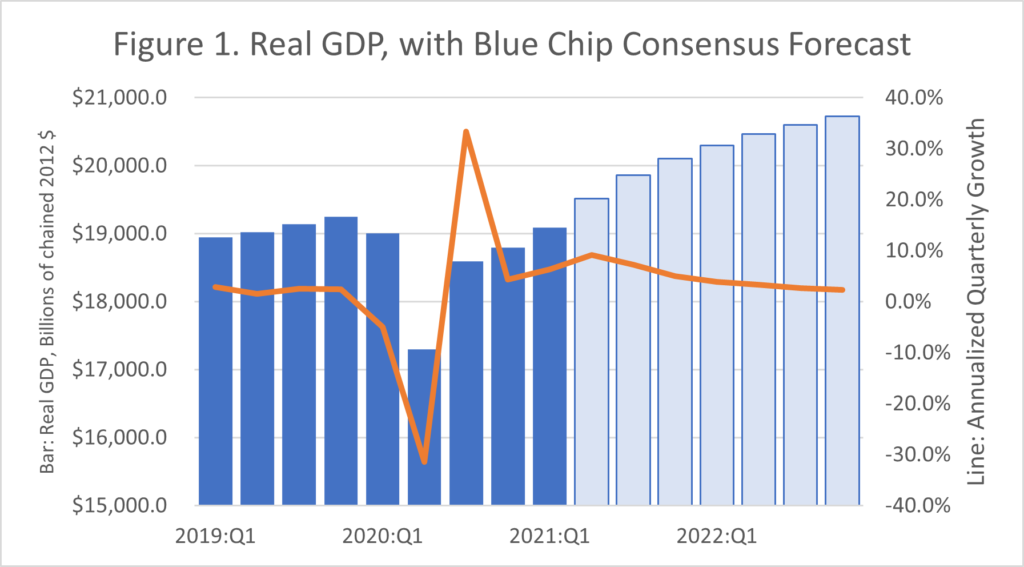

The U.S. economy grew at an annual rate of 6.4% in the first quarter. Growth was robust, but below expectations. While recovery began in the third quarter, growth has been inconsistent with a relatively weak growth in the fourth quarter. As of the first quarter, real GDP had not yet reached the pre-pandemic level set in the fourth quarter of 2019. That level has probably been reached in the second quarter however. Growth in the first quarter was led by consumer spending which was helped by federal stimulus. Federal spending on vaccinations also helped to drive growth.

Outlook Overview

The outlook going forward remains relatively optimistic with increased vaccinations, declining Covid cases and reduced restrictions on economic activity giving rise to above trend growth. Recent historical real GDP data along with the Blue Chip consensus forecast are depicted in figure 1. As already indicated, current projections have the nation returning to pre-Covid level in the second quarter with annualized quarterly growth rates falling to 2.4% by the end of 2022. The Blue Chip consensus forecast is 6.6% for 2021 and 4.4% for 2022.

Covid and the Economy

As of May 20, 2021, 48.2% of the total U.S. population have received at least one dose of vaccine and 38.1% have been fully vaccinated. The most recent 7-day moving average of daily new cases was down 19.5% from the previous 7-day average and 89% below the peak level of January 8, 2021. Oxford University has compiled rigorous and consistent measures of government response to the Covid crisis[1]. Among their data is a “Stringency Index” which records the strictness of lockdown policies. This includes such measures as school closures, business closures, travel restrictions, etc. The U.S. index reached a peak in November 2020 at a level of 75.46. As of May 22, 2021, the index was at 52.31 and trending down.

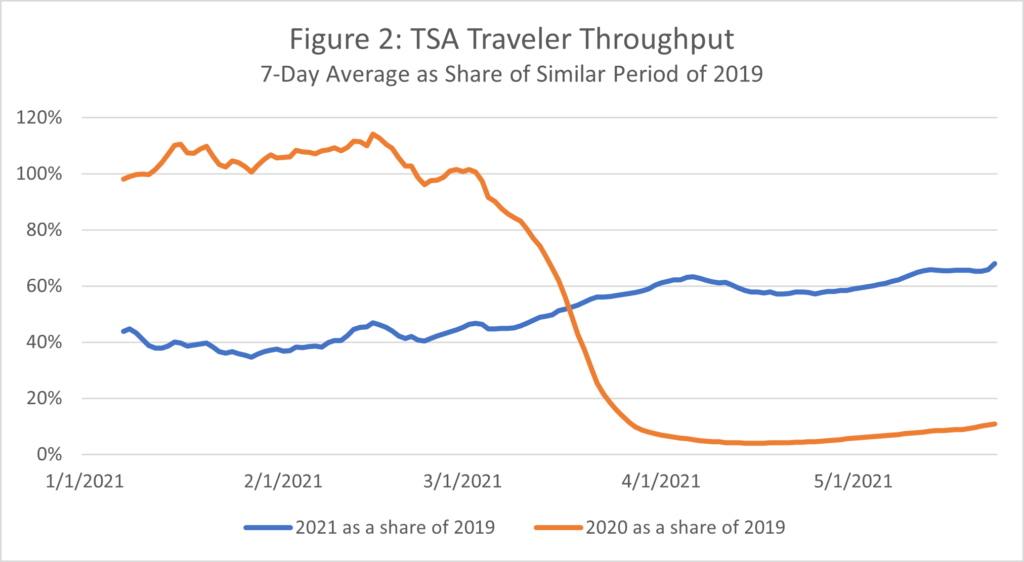

A variety of key indicators paint a similar picture of an economy coming back to life. Figure 2 compares the 7-day moving average of TSA traveler throughput in 2021 and 2020 data to a comparable period in 2019[2]. For the seven days ending on May 23, 2021, travel volume was 68.0% of 2019 level. For the comparable period of 2020, the travel volume was 10.9% of 2019.

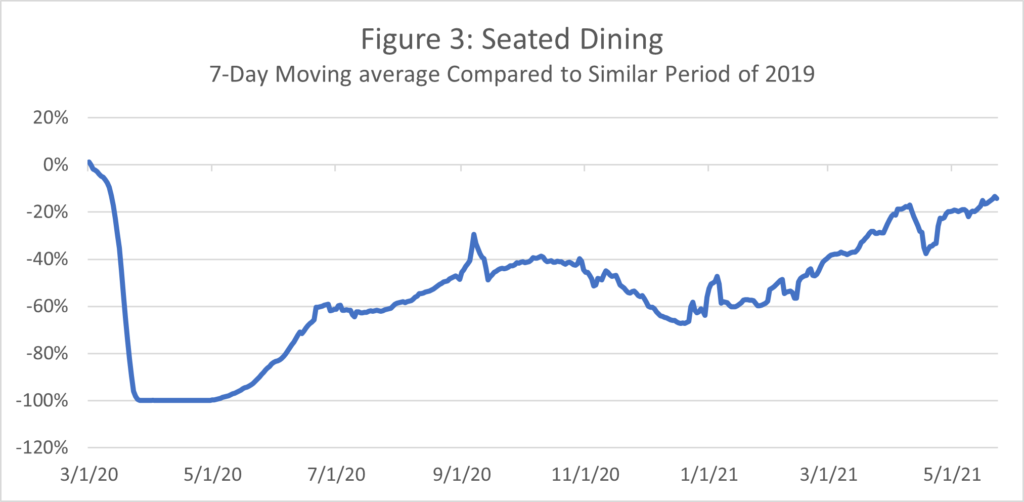

Figure 3 shows seated dining in 2020 and 2021 compared to 2019. This data is based on a sample of restaurants on the OpenTable network and includes only those restaurants that have reopened[3]. Since some restaurants have not yet reopened, the actual year-over-year decline is worse than what is depicted in the graph. Of those restaurants opened however, seated dining is down only 14% from 2019 for the seven days ending May 23, 20219. Just one month ago seated dining was down 33% and for the month of January average seated dining was 56.9% below the 2019 level.

According to STR, U.S. hotel occupancy rates reached their second highest level since the beginning of the pandemic during the week ending May 15, 2021[4]. The occupancy rate of 59.1% was down 16.4% from the comparable period of 2019.

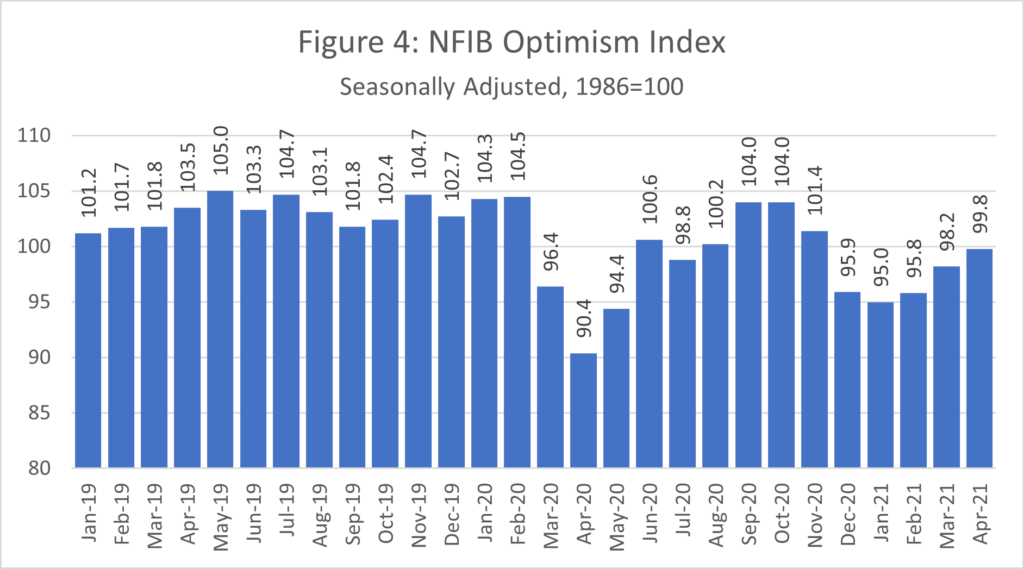

Figure 4 shows that the NFIB Small Business Optimism Index has improved for three consecutive months, but the index remains below that observed in August through November of 2020. Respondents complain of the availability of quality workers, taxes and government regulations.

Jobs and Inflation

Expanded unemployment benefits are playing a role in limiting the available workforce. The expanded benefits will end in September. The survey also revealed a rising trend in respondents plans to raise prices. Concerns for inflation are not surprising given continued supply chain disruptions. While inflation is expected to rise moderately over the next few quarters, longer-term or significant inflation is not anticipated. The May Blue Chip consensus forecast expects 2021 to average a 2.7% inflation rate before falling back to 2.2% in 2022.

Employment is improving, but at a slower pace than expected. Average monthly job gains for April were only 266,000 down from 770,000 jobs added in March. The March figure was in fact revised down from an initially reported figure of 916,000. Continued supply chain disruptions and chip shortages are being blamed for the reduced activity. The chip shortage in particular is being singled out as the culprit behind the 27,000 job decline in vehicle manufacturing.

On a more positive note, reduced Covid-related restriction led to a gain of 331,000 jobs in the leisure and hospitality sector. Over half of these gains were in eating and drinking places. The unemployment rate was 6.1%, up slightly from the 6.0% observed in March, but down substantially from the high-water mark of 14.8% observed in April 2020. It is typical for employment to recover more slowly than GDP. Employers often take a “wait-and-see” approach to hiring, especially in times of uncertainty. The pandemic and the subsequent government restrictions are likely to have impacted consumer behavior and businesses may want to get a better feel to how their customers will respond before committing to hiring. The continued supply chain disruptions are also causing delayed hiring.

GDP, Interest Rates, and Final Thoughts

While Real GDP has likely already reached its pre-pandemic level, it is below where it would have been without the pandemic. Furthermore, the pain of the lower production level is felt by some sectors more than others. White collar workers have adapted to working from home more readily than blue-collar workers. While savings rates have increased, some have had to rely on savings to survive. Some businesses have closed for good. The uneven nature of the recovery means banks will want to examine their market to see how their region is fairing.

Banks are likely to continue to face low interest rates. The Fed expects inflation to rise to 2.4% in 2021 but dip below the 2.0% target rate in 2022. Inflation is expected to settle around 2.1% by 2023. While the inflation projection for 2021 is above the 2% target level, the Fed views the continued slack in the labor market and the short-term nature of the inflation as meriting a continued easy stance on rates.

With low interest rates and uneven recovery, the current outlook warrants caution for banks. Risks include another spike in Covid cases which may be followed by further government restrictions and reduced consumer spending. Additionally, some Fed officials as well as some forecasters are concerned that supply bottlenecks and elevated demand could push prices higher than expected. If this happens, bank profitability will depend on how quickly the Fed responds.

Forecasts always come with risks and uncertainty and in that sense the current outlook is no different. However, the Covid-19 Recession is one of a kind and it is not yet clear how much it has changed our economy.

The outlook is relatively optimistic, but cautious optimism is wise.

[1] https://www.bsg.ox.ac.uk/research/research-projects/covid-19-government-response-tracker

[2] https://www.tsa.gov/coronavirus/passenger-throughput

[3] https://www.opentable.com/state-of-industry

[4] https://str.com/press-release/str-us-hotel-results-week-ending-15-may

How to cite this blog post (APA Style):

Premier Insights. (2021, May 27). May 2021 Economic Outlook for Banks [Blog post]. Retrieved from https://www.premierinsights.com/blog/may-2021-economic-outlook-for-banks.

Dr. Darrin Webb joined Premier Insights in September 2020 as Senior Economist, Macroeconomics and Forecasting. As the former State Economist for the State of Mississippi, Dr. Webb is a recognized expert in macroeconomics and forecasting. At Premier, Dr. Webb is leading the effort to more comprehensively and precisely address the qualitative component of CECL. Dr. Webb earned his PhD in Applied Economics from Clemson University.