Fair lending laws and regulations are broad and cover every phase of the lending transaction. This includes the initial inquiry and loan application process through the servicing and ultimate settlement of the debt. Accordingly, there are nearly an infinite range of possible pressure points that a lender may need to evaluate in order to assess fair lending risk.

Toward this end, one of the fundamentals is understanding the types of fair lending discrimination recognized by the regulatory and enforcement agencies. There are generally (3) recognized types of discrimination as it relates to fair lending. We briefly define and explain each in turn below.

Overt Discrimination

Overt discrimination is the easiest to understand and is what most people think about when they hear the word “discrimination.” Simply, it is obviously or blatantly providing or offering more favorable terms to one group versus another based solely on a prohibited factor, such as gender.

To most lenders this type of discrimination would be deemed the most likely NOT to occur and, therefore, may not receive much attention with respect to fair lending assessments.

However, overt does not necessarily mean deliberate as overt discrimination can be unintentional. For example, an institution may offer some type of loan product that has an age requirement that is inconsistent with the actual legal requirements resulting in discrimination based on age.

This can sometimes be in the form of special products or offers and can easily be overlooked by compliance staff. Although unintentional, these types of situations can, nevertheless, be deemed overt discrimination.

Disparate Treatment

Of the three types of discrimination, this is the most common and the most likely to be targeted in a fair lending review. Disparate treatment is differences or inconsistencies in treatment based on prohibited factors that are not fully explained by relevant, non-discriminatory factors.

Disparate treatment applies to a wide range of issues such as pricing, underwriting, or steering. Disparate treatment may be evaluated and tested by a file review or a statistical analysis of loan data. Most vulnerabilities institutions face with regard to fair lending will fall under the category of disparate treatment as it is driven by inconsistencies.

Disparate Impact

Disparate impact can be understood by thinking of it as somewhat of the mirror image of disparate treatment. Whereas disparate treatment is the result of inconsistencies, disparate impact involves, instead, consistency. Disparate impact is where consistent application of a policy results in an adverse impact on a protected class. The Interagency Fair Lending Examination Procedures probably define it best and is as follows:

When a lender applies a racially or otherwise neutral policy or practice equally to all credit applicants, but the policy or practice disproportionately excludes or burdens certain persons on a prohibited basis, the policy or practice is described as having a “disparate impact.”

A simple example may be having a minimum credit score or loan amount requirement. A lender may be completely consistent and never deviate from the policy, but if it adversely impacts a protected class, the institution should be able to demonstrate “business necessity.”

We should point out here that disparate impact is controversial and has been the subject of much debate. The good news is that it is seldom the type of discrimination that is the target of most fair lending reviews and inquiries.

Conclusion

It is important to understand the types of discriminations that can occur in order to fully evaluate fair lending risk. Overt discrimination may be blatant or obvious, but lenders should understand it can occur inadvertently. Disparate treatment is a risk where there are inconsistencies in a lender’s lending practices.

Disparate impact is application of an otherwise neutral policy that may be adverse to one group, although it is applied consistently. Although the most common is disparate treatment, the other two are also legitimate risks and should not be ignored.

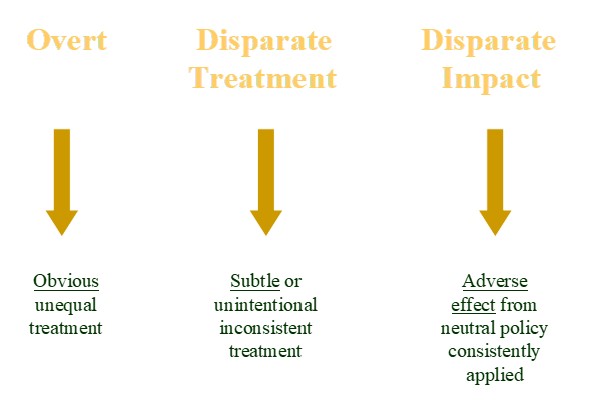

The graphic below provides a quick summary of the three recognized forms of Fair Lending Discrimination.