As lenders face increasing scrutiny from the regulatory and enforcement agencies with regard to fair lending in general, and redlining in particular, institutions are searching for ways to mitigate these risks.

Why Correcting a Problem is So Hard

Fair lending risk management now demands a data-centered strategy, as the focal point of a redlining examination, or in the worst case, an enforcement action, which is based on an institution’s lending volume in critical geographies.

Although other factors are routinely considered, such as marketing efforts, branch locations, training, and the like, the overarching consideration is how a lender is performing with respect to loan volume in sensitive geographies as well as with regard to race and ethnicity. This involves quantification and measurement based on key metrics to evaluate whether an institution’s lending patterns reflect equity and parity with regard to minority and non-minority communities and race and ethnicity. We have provided examples of such measurements in previous posts.

It is, therefore, quickly becoming a necessity for lenders to not only monitor their lending patterns, but to have ways to positively affect their lending distributions as it relates to key fair lending benchmarks in order to remain within certain thresholds. Doing so is the best way – and potentially the only way – to lower fair lending risk and reduce regulatory uncertainty.

Although it varies by institution depending upon a number of factors including size, locations, competitive position(s) in their markets, and product mix relative to other lenders, being effective in this regard can be a significant challenge.

Compounding this is that virtually all lenders are facing similar pressures from their regulator, which creates additional competitive barriers in addition to other challenges they may face in order to “move the needle” in terms of their lending patterns. Larger lenders in particular have more resources and the ability to raise the stakes in competing for the share of loans in minority communities and among minority individuals, potentially making it more difficult for other lenders. Further amplifying the challenge is that lending is evaluated on an annual basis typically, meaning that performance must be sustainable over time.

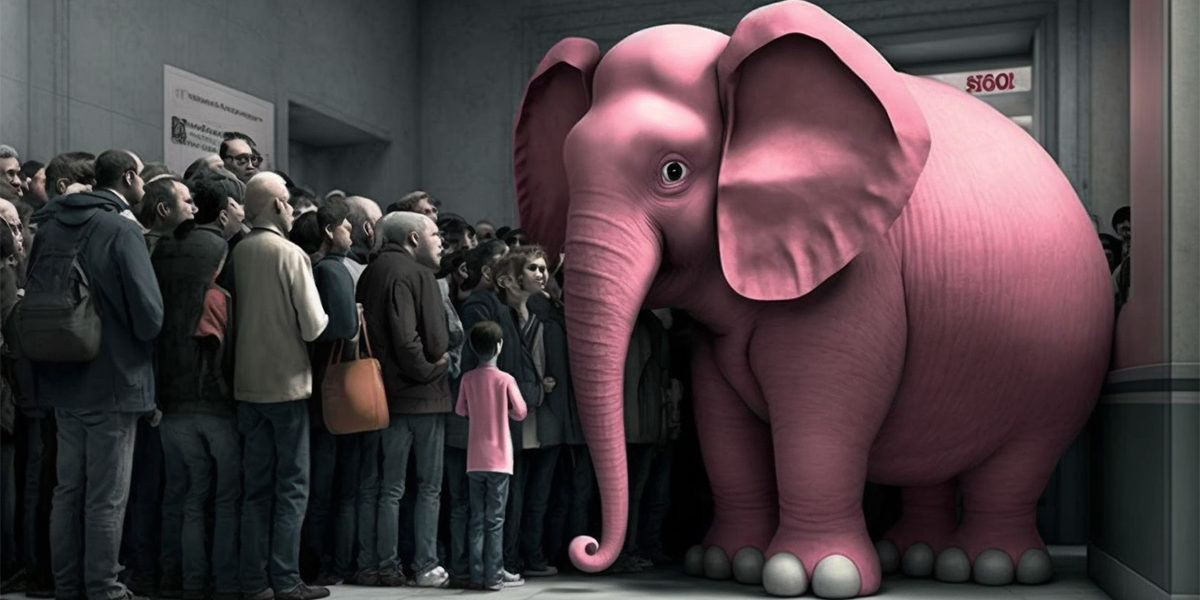

All these factors combined, along with the fundamental difficulty of deploying the effort and resources required to effectively develop new business, have proven to be a daunting task for many institutions faced with regulatory criticism of their lending. As an even further hindrance, standing starkly in the background, always present but seldom discussed, is the elephant in the room of the fair lending regulations themselves which prohibit a lender from making racial considerations with regard to lending activity.

The regulations make illegal nearly all of the essential elements required to have an effective marketing program that can effectively address fair lending concerns, from specifically prohibiting targeting individuals and areas based on race, to offering special terms and conditions based on racial considerations. All of these would be considered overt discrimination under fair lending laws and, therefore, direct violations of the Equal Credit Opportunity Act and the Fair Housing Act.

How then, can a lender market to, and specifically target, minority individuals and minority communities for loan products without considering race and ethnicity?

The Problem With an Income-Based Approach

Historically, this has been addressed within a Community Reinvestment Act framework. The CRA considers income levels, so targeting specific areas or individuals based on income or offering special terms and conditions based on the same does not constitute a fair lending issue. In fact, lenders are strongly encouraged and MUST provide credit opportunities to lower income borrowers and communities in order to fulfill their CRA regulatory obligations.

Because majority-minority communities and borrowers have tended to be lower income than non-minority areas and borrowers, such a framework has been effective to some extent for lenders in reaching these communities. However, such an approach has become less effective for a few different reasons.

First, the demographics are changing. While minority individuals and areas, on average, may have lower income than non-minority, this is becoming less and less the case. Lenders that tailor their products and build their efforts based on income-level approaches are importantly missing a portion of their target audiences.

Second, geo-demographically, the population is becoming increasingly diverse. Census tracts have become more heterogeneous in terms of the population compositions within them, making it more difficult to center-in on the target demographic. These two reasons alone are why many efforts that are made by lenders come up short – they are not truly focused on who they are trying to reach, meaning a significant portion of their resources are wasted.

Third, and as mentioned earlier, this is all augmented by growing competition for these credits from other lenders due to regulatory priorities and pressures.

Enter Special Purpose Credit Programs

Seemingly as a response to some of these complications and to further the regulatory agenda, the regulatory and enforcement agencies issued a joint statement February 22, 2022, regarding “Special Purpose Credit Programs” or SPCP’s. The stated intent of the announcement was to “remind creditors of the ability under the Equal Credit Opportunity Act (ECOA) and Regulation B to establish special purpose credit programs to meet the credit needs of specified classes of persons.”

The statement further stated: “As creditors consider how they may expand access to credit to better address special social needs, the agencies encourage creditors to explore opportunities to develop special purpose credit programs consistent with ECOA and Regulation B requirements as well as applicable safe and sound lending principles. ” The CFPB, HUD, and the DOJ have all issued independent statements in support of such programs.

But what is a “Special Purpose Credit Program”, or SPCP? There are a host of nuances and associated requirements to be considered with developing and implementing such a program, all of which are beyond the scope of this post. These are both legal and procedural and would require a great deal of due diligence and assistance from legal counsel in interpreting and implementing such a program.

Essentially, however, this has been presented as a special “carve out” to the basic tenants of the ECOA and the FHA which prohibit preferences on a prohibited basis with regard to credit products, and instead allow such preferences IF they are intended to expand borrowing opportunities to historically disadvantaged groups. The implementation of such a program would afford a lender the opportunity to explicitly target products based on a prohibited basis, such as race or ethnicity, as well as offer preferential terms and conditions in order to attract borrowers, therefore, eliminating the “elephant in the room”.

Is implementing such a program right for your institution?

Many industry observers remain leery of such programs as, while maybe well intended, on their face they seem to be a direct violation of fair lending laws. Although the agencies have issued a number of statements and opinions regarding and encouraging such programs, our reading of these still appear vague as to not only how such a program circumvents the fundamental principles of fair lending, and it is not entirely clear what constitutes a “qualified” program.

This guidance also falls short of providing any type of guarantee or “safe harbor” for lenders that choose to go down this path. The agencies further will not approve or qualify programs but only offer feedback as stated in the interagency statement: “While the agencies do not determine whether a program qualifies for special purpose credit status, creditors with questions about any aspect of ECOA and Regulation B’s special purpose credit provisions may consult their appropriate regulatory agencies.”

Determining if the implementation of such a program is right for your institution should be assessed from a risk-reward perspective. We suggest the following considerations:

- Is your institution well and consistently behind other institutions in terms of lending to minority individuals or majority-minority areas in one or more markets?

- Has your institution struggled with making significant and sustainable gains in terms of redlining related performance?

- Does your institution face competition from larger lenders and/or lenders that have developed and implemented SPCP’s in any of your critical markets?

- Have any recent regulatory inquiries or examinations cited poor lending performance with regard to redlining?

If any of these are true for your institution, a SPCP may be something to explore. For a further and robust discussion of specific details surrounding SPCP’s, see Consumer Compliance Outlook, Fourth Issue, 2022.

The Bottom Line

If your institution is considering a SPCP, we firmly believe that it must be coupled with a plan and measurable objectives, and that’s what we specialize in here at Premier Insights.

If your bank would like to discuss SPCPs or the need to consider them, please reach out to us to discuss our fair lending consulting and other analytical services that have helped our customers face regulatory scrutiny for nearly 30 years.

DOES YOUR BANK NEED TO DISCUSS SPCPs?

Contact us today to discuss your needs. Let our nearly 30 years of experience back you up when the regulators next come poking around your bank.