The Hidden Dangers of Fair Lending Redlining: How It Can Harm Your Bank and Your Customers

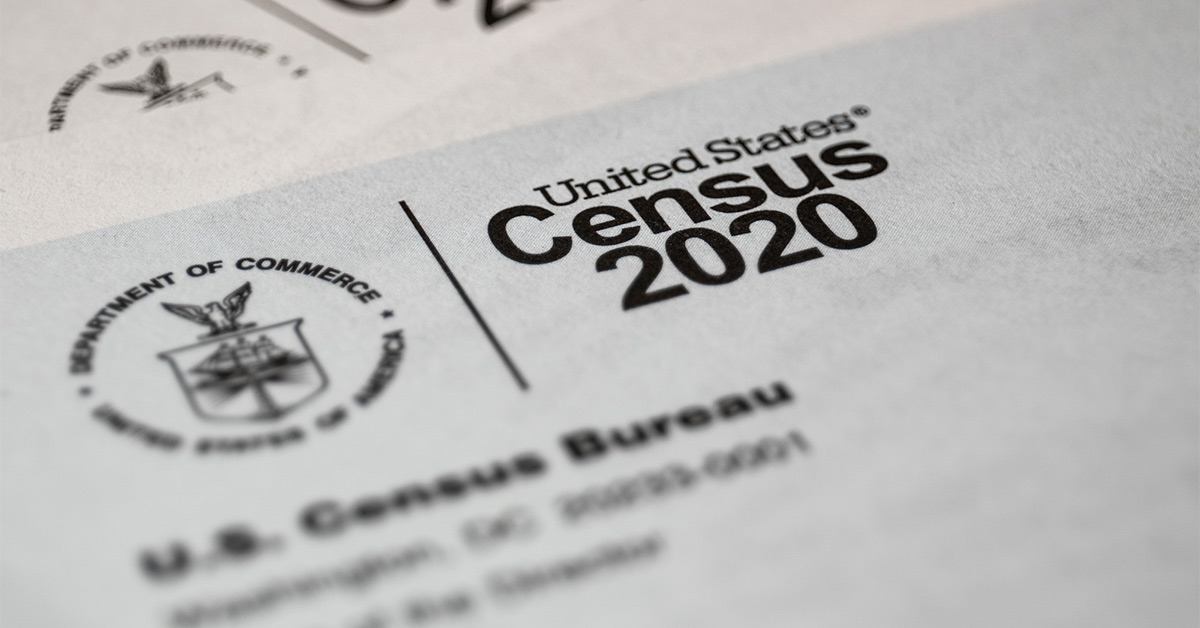

You know the importance of ensuring compliance with fair lending regulations. But have you considered the dangers of redlining specifically and completely? Redlining Defined Redlining is the practice of denying or limiting financial services to certain neighborhoods or areas, often based on factors such as race, ethnicity, or income level. While it is illegal, redlining […]

Read More